The car modification industry is more than just a realm for passionate enthusiasts; it significantly influences the economy at large. As hobbyist car modifiers, professional tuners, classic car restoration enthusiasts, and global fans converge, they weave a rich tapestry of economic dynamics that includes job creation, market growth, and technological advancements. Through its multifaceted contributions—ranging from bolstering local businesses to igniting innovation within the automotive sector—this industry reveals its capacity to alter economic trajectories. Each chapter here will unravel the ways in which the car modification industry shapes our economies, empowering readers to comprehend its broader significance while nurturing their individual passion for automobile enhancement.

From Garage to GDP: How Car Modification Fuels Market Growth and Direct Economic Value

Direct Economic Contribution and Market Trajectory

The car modification industry converts individual tastes into measurable economic value. What begins as a consumer choice—to personalize, improve, or repurpose a vehicle—ripples into manufacturing orders, service revenue, and new business models. Revenue flows from multiple sources: aftermarket parts sales, specialist installation labor, digital design services, and events that aggregate demand. Together, these streams form a dense ecosystem that supports firms of all sizes, from small shops to large component manufacturers, and injects direct spending into local and national economies.

Manufacturing sits at the heart of this contribution. The production of performance components, aesthetic kits, and electronic modules creates demand for raw materials, precision tooling, and assembly labor. Specialized manufacturers scale to meet niche needs while larger suppliers adapt product lines for aftermarket compatibility. That activity sustains jobs on factory floors and in engineering departments. It also generates taxable income and capital investment. When a component maker scales up to supply regional markets, it buys more materials, hires technicians, and often invests in machinery. Those purchases create secondary demand across supply chains.

Retail and distribution translate manufacturing output into consumer purchases. Independent retailers, online marketplaces, and specialist distributors form the commercial backbone that connects suppliers to vehicle owners. This distribution layer adds value through inventory management, marketing, and warranty support. In regions with strong automotive cultures, retail hubs and concentrated aftermarket markets can become economic clusters. Concentration leads to efficiencies that attract complementary businesses such as tuning schools, parts testing facilities, and logistics providers. Each new business in a cluster amplifies the local economic base through spending and tax revenue.

Skilled services are another direct channel. Installation, tuning, diagnostics, and repair require trained technicians and diagnostic tools. Shops that provide these services generate recurring revenue streams, because modifications often require calibration, maintenance, or upgrades over time. Training providers and vocational schools benefit as they supply the workforce. That creates a pipeline of skilled labor, enhancing local human capital and supporting higher wages for specialized roles. As a result, areas with dense modification activity can see meaningful growth in technical employment.

The creative and digital industries around modification also add measurable value. Design studios, 3D modelers, and digital branding teams craft bespoke aesthetics and marketing campaigns. These creative roles intersect with manufacturing when digital prototypes move to physical production. The interplay raises demand for software licenses, render farms, and professional services—creating a multiplier effect that spreads economic benefits into adjacent sectors, including advertising, media production, and software development.

Government policy amplifies direct contributions. When regulators provide clarity, industry participants invest with greater confidence. For example, a multi-ministry policy that supports standardized development of auto modification and related industries can unlock new markets. Policies that explicitly encourage motorsports, RV tourism, or classic vehicle culture turn hobbyist demand into broader commercial activity. That policy-driven expansion expands manufacturing orders and retail sales, and can stimulate tourism revenue tied to events and exhibitions. In some markets, targeted policies help small shops become formal businesses, increasing tax base and regulatory compliance.

Market growth trends underscore the scale of this impact. Recent market analyses show the global sector valued in the tens of billions of dollars and expanding year over year. Projections vary, but they consistently indicate upward momentum. Estimates show the market near USD 60 billion in the mid-2020s, with forecasts pointing to continued growth through the next decade. This trajectory reflects both rising vehicle ownership in large markets and a cultural shift: owners increasingly view cars as customizable lifestyle assets rather than mere transport.

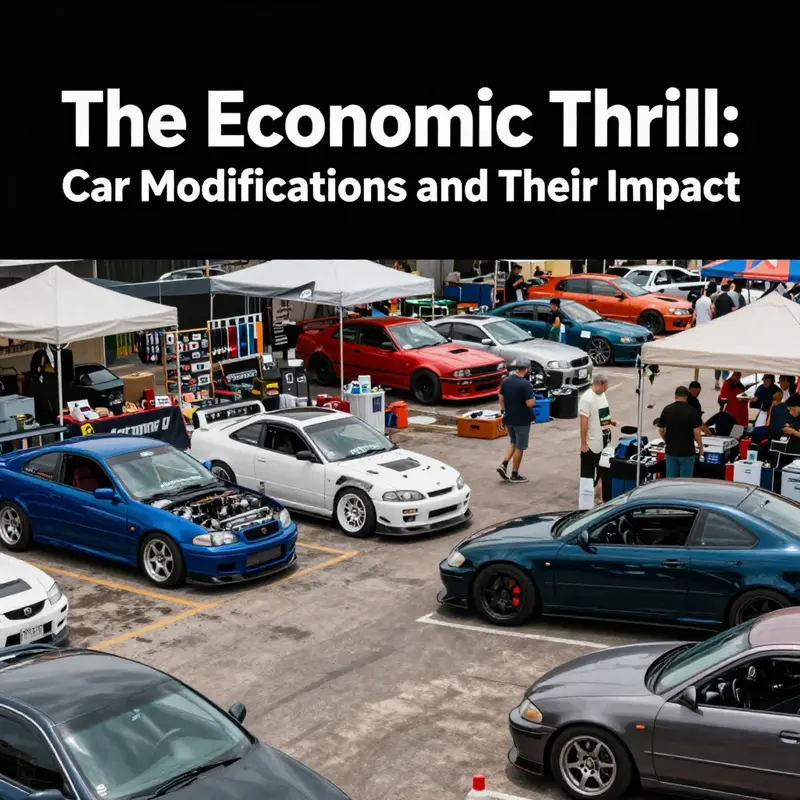

Consumer spending patterns drive much of that expansion. Owners invest in personalization for identity, performance improvements, or enhanced comfort. Those discretionary purchases tend to skew toward higher-margin products and services. Upgrades that transform a vehicle into a specialized utility—such as for camping, motorsport, or commercial use—pull more complex supply chains into play. Events like car shows and racing meetups also generate ticket sales, vendor revenue, and local tourism income. These activities expand internal demand well beyond parts and labor, stimulating hospitality and retail sectors.

Geography shapes market dynamics. In countries with large vehicle fleets, even small per-vehicle modification rates produce significant aggregate demand. For instance, markets with hundreds of millions of registered vehicles represent vast potential. Regional preferences influence product mixes and services. Some markets favor aesthetic customization and lifestyle conversions. Others emphasize performance tuning or utility retrofits. Local policy environments and cultural attitudes toward vehicle personalization determine how quickly these niches mature into mainstream economic contributors.

Growth also creates opportunities for entrepreneurship. Lower barriers to digital storefronts and social media marketing allow small shops to reach global customers. Entrepreneurs can specialize in narrow product categories, such as custom lighting or suspension kits, and scale through e-commerce. Access to digital payment systems and logistics partners reduces entry costs, enabling rapid expansion. This democratization of market access spreads economic gains across broader groups, including micro-entrepreneurs and regional manufacturers.

Supply-chain integration magnifies direct economic effects. As aftermarket firms collaborate with original equipment manufacturers and Tier-1 suppliers, they create more efficient channels for innovation and production. Component standardization and quality improvements make aftermarket parts safer and more interoperable. Deeper integration also helps domestic firms capture greater value by shifting production from imported components to locally manufactured parts. The resulting import substitution can improve trade balances and support higher-skilled manufacturing jobs.

Innovation born in the modification sector often migrates into mainstream automotive technology. Modders demand lightweight materials, advanced electronics, and modular systems. Suppliers respond with new material solutions and electronic modules that eventually find application in factory-built vehicles. This process shortens the path from concept to commercialization. Early adoption in aftermarket contexts provides real-world testing at lower cost. When successful, technologies scale up for broader production, boosting national productivity and competitiveness in global markets.

Economic resilience is another dimension of direct contribution. The aftermarket can provide countercyclical support during downturns. Vehicle owners often keep older cars longer during economic slowdowns, and those owners invest in maintenance and upgrades. Such spending sustains jobs when new vehicle sales decline. Likewise, a vibrant aftermarket helps absorb labor displaced from OEM cycles, as workers transition to smaller shops and service providers. This adaptability helps local economies smooth shocks tied to broader automotive cycles.

To realize full potential, regulatory clarity matters. Where rules around modifications are predictable and transparent, investment follows. Conversely, ambiguous or restrictive approval processes stifle growth. Clear inspection standards, defined responsibilities among agencies, and incentives for formalization help convert informal modification activity into taxable, regulated commerce. Smart policy reduces safety risks while enabling entrepreneurs to scale, improving the industry’s ability to contribute steadily to GDP.

Understanding costs is essential for forecasting market size. Typical modification projects range widely in price. Some upgrades are low-cost aesthetic changes; others require thousands in parts and labor. For consumers and businesses, clarity about cost ranges helps plan investments and price services competitively. Resources that describe typical expenditures and installation requirements reduce uncertainty. For guidance on expected costs and factors that influence price, see this overview of how much car modification typically costs: how much does car modification cost.

Taken together, direct sales, service revenue, manufacturing orders, and related creative industries build a substantial economic footprint. Market growth projections and policy support suggest that footprint will expand. As the industry matures, integration with mainstream automotive supply chains, increased domestic production, and clearer regulation will convert hobbyist spending into sustained economic activity. Continued monitoring of market data remains essential, and more detailed projections are available in market analyses that survey growth through 2033. For an in-depth market forecast, see this analysis of the global car modification market (2026–2033): https://www.linkedin.com/pulse/global-car-modification-market-analysis-2026-2033-samuel-david-azwqj/.

Engineering Growth: The Economic Ripple of Car Modification Through Jobs, Ecosystems, and Innovation

When a car is modified, the changes ripple far beyond horsepower or aesthetics. The modification economy stitches together makers, designers, technicians, retailers, and digital specialists into a coordinated system that supports growth across regions. This chapter traces how job creation and a robust, interconnected ecosystem emerge from a demand for personalized mobility. It is not merely a cultural shift toward customization; it is a structural one that reallocates resources, hones skills, and speeds innovation in adjacent industries. As the market expands, the direct forms of employment multiply into a web of opportunities across the value chain, reinforcing both manufacturing and services sectors while nurturing a culture of experimentation that pushes new technologies from the workshop into mass production. The latest market analyses put the scale of this sector in a striking range: the global car modification market was valued at USD 60.27 billion in 2025 and is projected to reach USD 82.14 billion by 2033, reflecting steady, long-run growth with a compound annual growth rate around 3.45%. Those numbers are not mere headlines; they translate into livelihoods, new lines of business, and broader economic resilience that can be felt in communities large and small.

The most visible thread in this tapestry is direct employment. On the factory floor and in the aftermarket, specialized manufacturing has grown into a broad spectrum of roles. Companies producing performance engines, exhaust systems, suspension upgrades, aerodynamic components, and interior trim rely on engineers, machinists, and technicians who bring precision to customization. Even within the retail sphere, the demand for aftermarket parts has expanded the workforce to include retailers, distributors, and a growing cadre of online platforms that connect buyers with sellers across borders. But the job story does not stop at the point of sale. Installation teams, calibration specialists, and diagnostic technicians form a pipeline that starts with the moment an order is placed and extends long after a modification is completed. These roles require a blend of hands-on skill and analytical thinking, elevating vocational training into a pathway for career development. Parallel to traditional manufacturing and service roles, the rise of digital marketing, e-commerce logistics, and customer support has created new jobs in data analytics, user experience design, and community management. The pattern is a modern one: as consumers seek more personalized experiences, the labor market expands to meet the demand with specialized expertise that aligns with global supply chains and regional industry clusters.

This expansion is not superficial; it deepens because the modification ecosystem is inherently multi-layered. Beyond the obvious consumer-facing products, the industry fuels demand for advanced materials, precision machining, and electronics integration. Lightweight composites, carbon fiber components, and high-strength alloys appear not just in racing or show cars but as part of broader manufacturing innovations. The electronics frontier—cellularly connected performance modules, real-time telemetry, adaptive suspensions, and integrated infotainment upgrades—demands software developers, embedded systems engineers, and calibration specialists. As these technologies move along the value chain, they create spillover effects that strengthen related sectors: automotive electronics, advanced manufacturing services, and even consumer electronics supply networks. The deployment of smart sensors, connectivity modules, and real-time data analytics expands opportunities for SMEs and larger firms alike, providing a testing ground for technologies that can later scale to mainstream automotive applications.

A sustainable ecosystem hinges on more than skilled labor; it depends on resilient networks of collaboration. The car modification industry thrives where OEMs, Tier-1 suppliers, and independent aftermarket firms converge into an integrated ecosystem. Local shops and regional manufacturers benefit from access to a diversified customer base and cross-border trade in high-value components. This cooperative model reduces costs, shortens lead times, and accelerates innovation, as independent shops contribute nimble feedback loops that large-scale manufacturing cannot always achieve. When a small workshop for bespoke bodywork or custom paint attracts skilled specialists, it also attracts a broader set of service providers—detailers, wrap technicians, and branding studios—that together create a cultural ecosystem around the vehicle as an expression of identity. The result is a regional economy where a handful of niche competences can attract demand from distant markets, supported by a network of suppliers, logistics providers, and financing options that align with the needs of modders.

Economic spillovers extend well beyond the shop floor. The modification economy threads into insurance, financing, and event-driven tourism that together amplify its macroeconomic footprint. Insurance markets respond to changing risk profiles as vehicles become more complex or perform differently under enhanced conditions. Financing becomes more nuanced as lenders assess the value of customized attributes and the potential impact on resale. These financial dynamics create additional employment opportunities in underwriting, risk analysis, and customer service, while also shaping consumer behavior through new credit products and risk-based pricing models. At the same time, car shows, racing events, and cultural festivals anchored by customization culture generate tourism, hospitality, and local retail activity. These events convert garages and workshops into venues for experiential consumption, drawing visitors who contribute to regional economies through lodging, food service, and ancillary shopping. In this sense, the modification economy operates much like a cultural economy—where identity, spectacle, and technical prowess converge to drive local demand for goods and services across multiple sectors.

The scale of the market provides a useful lens for understanding the macroeconomic implications. Market analyses estimate the global car modification market at USD 60.27 billion in 2025 and project it to USD 82.14 billion by 2033, underscoring persistent demand and a broad geographic footprint. This trajectory signals a durable source of employment that is less volatile than some commodity-driven sectors, especially when regional policies support consumer interest in personalization. The 3.45% CAGR cited in industry reports signals stability and gradual expansion, which translates into predictable hiring pipelines, long-run supplier commitments, and community investment in training and infrastructure. As regions cultivate automotive clusters—ranging from design studios and high-performance component manufacturers to independent garages—the economic benefits accrue through wage gains, tax revenues, and after-market services that sustain a diversified regional economy. The modification economy thus acts as a catalyst for industrial maturity: it motivates firms to upgrade their capabilities, invest in workforce development, and pursue export opportunities for higher-value components and services.

Policy environments play a crucial supporting role in shaping these outcomes. Positive regulatory clarity around vehicle modifications and inspections creates a more predictable environment for investment and growth. Central plans that encourage consumer goods renewal and automotive customization contribute to higher domestic value-add and export potential. Yet, regulatory friction remains a constraint in some contexts. Complex approval processes for certain modifications—such as full-body wraps or powertrain alterations—can slow innovation and deter some entrants from scaling up. Industry observers advocate for high-level, actionable policies that assign clear responsibilities and provide targeted incentives. In the long run, coherent policies that balance safety, consumer protection, and economic opportunity are essential to unlocking the full potential of the ecosystem, particularly as countries map out pathways during major upcoming planning horizons like the 14th Five-Year Plan period. When policy supports the ecosystem, it does not merely benefit technicians and shop owners; it propagates through the supply chain, lifting material suppliers, software developers, training institutions, and logistics networks that underpin a nation’s manufacturing strengths.

The internal dynamics of consumer demand also matter. A cultural shift toward treating cars as personal expression, mobility, and even mobile living spaces expands discretionary spending and sustains demand for premium and bespoke experiences. This consumer trend feeds into a broader experiential economy, where people seek memorable engagements—whether through a high-profile show, a track day, or a customized vehicle that is both performance-oriented and aesthetically distinctive. As households allocate a portion of their budgets to customization, the industry benefits from a feedback loop: consumer desire fuels business investment in design and fabrication, which in turn spurs further innovation and a more sophisticated supply chain. In regions with large, established automotive cultures, such as those with significant numbers of enthusiasts and robust aftermarket ecosystems, the effects are magnified through a concentration of skilled labor, advanced fabrication capabilities, and a dense network of service providers who can support complex builds.

This integrated picture of jobs and ecosystem development helps explain why the car modification sector is increasingly viewed as a strategic asset for modern economies. It is not just about the direct jobs created by assembling components or installing upgrades; it is about the way the industry catalyzes innovation, strengthens supply chains, and expands the set of competencies available within a region. The presence of design studios, digital modeling, and branding services highlights how the industry blends manufacturing with creative industries. The result is a more adaptable, technology-driven economic segment that aligns well with broader goals of productivity, resilience, and competitiveness. As the industry evolves, the interplay between OEMs, independent shops, and new-media platforms will likely intensify, enabling more efficient production, faster customization cycles, and a more vibrant ecosystem of small and mid-sized enterprises that contribute to regional GDP and innovation ecosystems.

For readers seeking to explore the policy and practical implications of these dynamics, it is instructive to consider how insurance and risk factors shape the economic calculus of modification. The ways in which modifications affect insurance premiums, coverage decisions, and risk mitigation influence consumer decisions and the financial viability of projects. Understanding these dynamics helps explain why some regions see faster growth than others and why policymakers should consider coordinated approaches that address safety, consumer protection, and economic incentives in tandem. By examining the modifiable interfaces between policy, industry, and consumer behavior, stakeholders can craft policies that support job growth and ecosystem development without compromising safety or sustainability. insurance implications for modified cars can be a useful focal point for such discussions, offering a concrete lens through which to assess risk, incentives, and market opportunities. insurance implications for modified cars.

Ultimately, the economic value of the car modification sector rests on its capacity to translate consumer curiosity into durable skills, scalable processes, and resilient networks. Talent pools expand as new specialties emerge—ranging from lightweight materials engineering to software-driven tuning and remote diagnostics. SMEs gain access to more diverse markets, while larger manufacturers can accelerate innovation by integrating feedback from independent shops into product development cycles. The social and economic payoff is not limited to jobs; it extends to local tax bases, education and training ecosystems, and regional reputation as centers of advanced manufacturing and design. In this sense, the car modification industry embodies a broader truth about the modern economy: when people are empowered to shape products that reflect identity and performance, industry can become a truly creative engine for growth. The pathways from hobbyist garages to global supply chains are not linear, but they are increasingly integrated, collaborative, and capable of delivering broader prosperity. External resources corroborate this trend, offering deeper dives into the market dynamics and the strategic implications for policymakers and business leaders alike: the Grand View Research report on car modification market size, share, and growth provides a comprehensive benchmark for understanding the scale and trajectory of this evolving sector.

External resource: https://www.grandviewresearch.com/industry-analysis/car-modification-market

From Garage to Assembly Line: How Car Modification Fuels Automotive Innovation

How car modification becomes a source of innovation and technology

The car modification industry functions as a living laboratory where ideas move quickly from concept to test. Enthusiasts, small shops, and niche manufacturers experiment with parts, materials, and software. These experiments often reveal practical solutions that larger firms adopt later. That informal R&D accelerates technological progress across the broader automotive economy.

Customization pushes boundaries in mechanical engineering. Tuners and fabricators pursue more power, better handling, and lighter weight. They probe limits of engines, transmissions, and chassis dynamics. That search for improved performance drives refinements in engine mapping, forced induction, and thermal management. Those refinements feed back into mainstream engine development. Engineers working in OEMs watch trends in the aftermarket and adapt proven ideas for mass production.

Materials science sees rapid iteration in the modification ecosystem. Enthusiasts demand parts that reduce mass while keeping strength. This demand has helped scale production of advanced composites and high-strength alloys. Small suppliers experiment with carbon-fiber components, hybrid laminates, and novel bonding techniques. As production techniques mature, unit costs fall. That lowers barriers for larger manufacturers to incorporate lightweight materials. The net effect is improved efficiency across many vehicle classes.

Electronics and software follow a similar path. Modern modifications blend hardware changes with sophisticated coding. Programmable engine control units, aftermarket telemetry, and adaptive suspension controllers are common. Independent developers create tuning software that refines fuel delivery, ignition timing, and boost control. Those tools teach engineers about behavioral edge cases and performance envelopes. Automotive companies, in turn, absorb lessons on software architecture and control logic.

Connected and smart features also emerge from the aftermarket. Add-on telematics, real-time data logging, and driver-feedback systems are first adopted by hobbyists. They push telemetry into mainstream conversation, creating demand for factory-installed data systems. The aftermarket’s appetite for connectivity encourages standardized interfaces and open protocols. Those standards make it easier for OEMs to plan future software ecosystems.

The industry’s role as a testing ground extends to safety and human factors research. Modders frequently combine non-standard hardware with driver aids. Observing how drivers interact with those systems yields insights on usability. For example, how drivers interpret augmented instrument clusters or custom heads-up displays can guide safer designs for production vehicles. In this way, grassroots modification can inform regulatory and ergonomic decisions.

Electric vehicles (EVs) and hybrid drivetrains have opened fresh avenues for modification-driven innovation. Battery packs, electric motors, and power electronics are now subjects of aftermarket attention. Firms and hobbyists explore range optimization, regenerative braking tuning, and thermal management. The experimentation uncovers practical strategies for energy recovery and cooling. These findings help OEMs by highlighting failure modes and pointing to efficient subsystem architectures.

Software-defined vehicles create the next frontier. When control shifts to software, modification becomes a software discipline as much as a mechanical one. Enthusiasts modify firmware, add custom user interfaces, and script vehicle behaviors. This activity increases demand for secure, modular software platforms. The result is pressure on manufacturers to support over-the-air updates, sandboxed third-party apps, and robust cybersecurity. A vibrant aftermarket thus nudges the entire industry toward more open, upgradeable software stacks.

Additive manufacturing is another area where modification accelerates innovation. Small runs of custom brackets, bespoke housings, and one-off aesthetic parts are practical with 3D printing. Rapid prototyping shortens development cycles and lowers risk. Designers test shapes and fitment before investing in tooling. Success in the aftermarket demonstrates the economic viability of localized, on-demand manufacturing. That lesson influences supply-chain choices for larger producers.

The market dynamics of modification also stimulate formal R&D investment. Growing consumer interest signals commercial opportunities. As the market projects steady growth, both niche suppliers and major firms allocate budget to research. This investment supports advancements in sensors, lightweight composites, and control systems. In turn, these innovations create new product categories and services, expanding the industry’s economic footprint.

Human capital development matters. The industry creates specialized jobs in design, fabrication, software, and diagnostics. Apprenticeships and small training programs prepare technicians with cross-disciplinary skills. Those workers bring practical, hands-on knowledge into mainstream manufacturing. Their familiarity with rapid prototyping and customer-driven features helps firms innovate faster. This labor pipeline strengthens the broader automotive ecosystem.

Supply chains feel the ripple effects. Aftermarket demand spurs growth at Tier-2 and Tier-3 suppliers. Small suppliers scale production of sensors, connectors, and lightweight components. That scaling yields economies that benefit OEMs. Cross-pollination between aftermarket suppliers and traditional manufacturers enhances resilience. When domestic suppliers grow, nations strengthen their industrial base and improve export potential.

Public policy and regulation shape how innovation flows from modification into the mainstream. Clear, supportive frameworks encourage safe experimentation. Regulations that require standardized safety testing and emissions compliance motivate innovators to design responsibly. Conversely, restrictive or ambiguous rules can stifle beneficial experimentation. Policymakers who create predictable avenues for aftermarket testing help channel grassroots innovation toward public benefits.

The cultural influence of car modification also matters economically. Customization turns vehicles into lifestyle products. That shift increases consumer willingness to pay for advanced features and personalization. Automakers take note and introduce more configurable options, driving higher-margin sales. Car shows, racing events, and community gatherings showcase new technologies. Those venues become informal showcases for sensors, materials, and software, accelerating market acceptance.

Innovation in the modification industry is not limited to performance. Environmental and efficiency innovations are increasingly common. Modders experiment with low-drag bodywork, energy-efficient HVAC retrofits, and aerodynamic add-ons. When combined with lightweighting and powertrain tuning, those measures yield tangible fuel economy gains. Lessons learned in these small-scale projects often translate to improved fleet efficiency when adopted at scale.

Collaboration between the aftermarket and OEMs is growing. Partnerships, supplier agreements, and licensing deals turn successful mod concepts into production-ready solutions. This collaboration reduces R&D redundancy. It allows larger firms to adopt proven solutions faster. At the same time, independent innovators gain access to capital and manufacturing know-how. Those synergies magnify economic returns.

The industry also nurtures entrepreneurial ecosystems. Many high-growth companies began as aftermarket shops. They scaled from local services to national suppliers. Venture capital and industrial partners invest in startups that spin out from modification culture. Those investments create jobs, deepen technological capabilities, and increase exportable IP.

Finally, the innovation pipeline benefits consumers and society. Safety improves as aftermarket-derived systems migrate into factory builds. Efficiency gains reduce fuel use and emissions. Connectivity and software enhancements increase convenience and mobility. In aggregate, these benefits contribute to productivity and economic growth.

For practitioners and aspiring innovators, practical resources help accelerate skill acquisition. Those who want structured learning paths can explore dedicated guides on how to learn car modification. This resource offers step-by-step approaches to building mechanical and software skills, and connects enthusiasts with training opportunities and community networks. Learn more about practical learning pathways here: how to learn car modification.

For a detailed market view that contextualizes these trends, consult the broader sector analysis which projects continued growth. The market research report offers forecasts, segmentation, and technology trends that underline the economic importance of modification-driven innovation. Read the comprehensive market outlook here: https://www.marketresearchfuture.com/reports/car-modification-market-2957

The car modification industry will keep shaping technology. As vehicles become more software-centric and electrified, the aftermarket’s role will likely expand. Policymakers, OEMs, and suppliers that recognize and channel this creative force will capture the most value. The result will be faster innovation cycles, more resilient supply chains, and an automotive sector better tuned to consumer needs.

From Garage Labs to Global Networks: How Car Modifications Reinforce Supply Chains and Economic Stability

How car modification weaves into supply chains

The car modification industry strengthens both domestic and global supply chains. It does so by creating sustained demand for specialized parts and by driving continuous innovation. This demand reaches deep into manufacturing tiers, distribution networks, logistics services, and design houses. Small and medium-sized enterprises (SMEs) often supply performance engines, custom electronics, suspension systems, and specialty tires. Those SMEs expand tooling, improve processes, and invest in new materials. Their investments ripple outward, raising capacity and capability across regions.

Growth in aftermarket demand also motivates larger suppliers to diversify. Tier-1 and Tier-2 manufacturers adapt production lines and quality systems to serve both OEMs and the modification market. That dual focus increases utilization rates and spreads fixed costs over more output. It lowers per-unit costs and supports more resilient production networks. When modification firms require bespoke alloys or carbon composites, they push material suppliers to scale advanced manufacturing methods. Those methods then feed back into mainstream automotive production. The result is a stronger industrial base and better leverage for export markets.

International trade follows demand. Regions with established automotive clusters become exporters of high-value components. Countries known for advanced manufacturing scale up to serve aftermarket niches globally. For example, nations with strengths in electrification and battery supply chains can cross-leverage that expertise to produce high-performance powertrains and modules for modified electric vehicles. This cross-pollination makes supply chains more flexible. It lets components flow between consumer, performance, and industrial segments.

The size of the market matters. With the global modification market estimated above sixty billion dollars, investment incentives emerge naturally. Capital flows into CNC machining, additive manufacturing, and precision electronics. Those investments improve lead times and consistency. They also enable smaller firms to compete internationally. Digital design and rapid prototyping lower barriers to entry. An innovative workshop can go from concept to market far faster than before. This pace benefits the whole supply chain by proving new designs and validating manufacturing techniques quickly.

Clusters and regional ecosystems form around this activity. Cities with low-cost skilled labor and accessible logistics attract shops and factories. These clusters create dense supplier networks and talent pools. They reduce transaction costs and permit quicker feedback between designers and manufacturers. A tuning shop can coordinate with a local CNC shop and an electronics assembler to refine a product in weeks. That proximity speeds iteration. It also strengthens local employment and training opportunities.

Modification demand also changes the shape of distribution. Traditional dealer channels are joined by specialized retailers and robust e-commerce platforms. Online marketplaces let niche suppliers reach global customers without heavy distribution overhead. That shift supports micro-exporters and helps regions capture higher value from aftermarket sales. Logistics providers adapt too. They develop specialized packaging, returns processes, and express delivery options for high-value components. Those service improvements have spillover effects for other manufacturing sectors.

Software and electronics have become central to many modifications. Adaptive suspensions, telemetry systems, and connected infotainment upgrades rely on sophisticated hardware and firmware. This need increases demand for electronics manufacturers, embedded systems designers, and cybersecurity specialists. These suppliers often overlap with mainstream automotive electronics firms. The aftermarket thus acts as a parallel market for software innovation. Rapid firmware updates and modular hardware tested in modified vehicles can later be adopted by OEMs.

As electrification progresses, the aftermarket will further reinforce global supply networks. Modders increasingly seek battery optimization, thermal management upgrades, and power electronics solutions. That drives both innovation and capacity in EV component manufacturing. Firms that develop robust, high-performance modules for modified EVs can pivot to volume production for mainstream automakers. This capacity expansion helps national industries capture more of the EV value chain.

Policy and standards play a key role in shaping these effects. Clear regulatory frameworks enable suppliers to invest with confidence. Where authorities provide predictable rules for parts approval and vehicle inspection, companies can plan long-term. Conversely, complex approval processes for cosmetic or engine changes deter investment and fragment markets. Actionable, high-level policy that defines responsibilities and incentives encourages clustering. It also helps SMEs scale exports by aligning domestic standards with international norms.

Strategic public support amplifies positive outcomes. Vocational training programs tailored to aftermarket skills create a ready workforce. Grants for tooling and R&D lower entry costs for innovative firms. Export promotion focused on high-value components helps small suppliers reach new markets. When governments coordinate across trade, industry, and education ministries, they create an environment where local modification industries mature into competitive exporters.

Insurance, financing, and certification services evolve alongside manufacturing. Specialized insurance products arise to underwrite modified vehicles and higher-value parts. Lenders develop financing structures for modification projects. Certification bodies provide quality marks for aftermarket components. Each of these services strengthens supply chains by reducing commercial risk. They make complex transactions more predictable. In turn, predictability attracts investment and encourages specialization.

Cultural and event-driven demand also matters. Car shows, racing events, and enthusiast festivals generate concentrated purchasing and networking opportunities. These events act as market accelerators. Suppliers meet buyers, test products, and secure orders. That direct market feedback supports iterative product improvement. It also generates tourism revenues that sustain hospitality, retail, and transport businesses in host regions.

The modification industry fosters technology spillovers that improve overall automotive productivity. Additive manufacturing techniques refined for custom bodywork can reduce tooling costs for mass-produced parts. Lightweight materials developed for performance applications lower vehicle weight at scale. Precision electronics created for telemetry can enhance diagnostic tools used across service networks. These spillovers raise manufacturing efficiency and product quality nationally.

SMEs gain particular advantage from the aftermarket ecosystem. Niche specialization lets small firms capture high margins on bespoke parts. Those margins fund reinvestment and innovation. As firms grow, they hire more technicians and engineers, expanding the skilled labor pool. That growth creates career pathways in technical trades and engineering. It also diversifies local economies away from dependence on a single large employer.

Yet challenges remain. Fragmented standards across jurisdictions make cross-border trade costly. Intellectual property disputes over tunable software slow collaboration. Some regulatory regimes impose burdensome certification costs that small firms can ill afford. Addressing these issues requires a mix of public policy and industry-led initiatives. Harmonized standards, accessible certification pathways, and incubators that support software and hardware integration can help overcome these barriers.

Practical steps that amplify supply-chain benefits are straightforward. First, align inspection and approval processes regionally to reduce compliance costs. Second, support training centers that bridge design, electronics, and mechanical skills. Third, provide targeted funding for SMEs to adopt advanced manufacturing tools. Fourth, encourage partnerships between OEMs and aftermarket innovators to accelerate technology transfer. Finally, use trade promotion to open export channels for high-value components.

Entrepreneurship is central to this strategy. Resources that lower startup friction create more suppliers. Aspiring founders benefit from concrete guidance on running a shop and scaling production. For practical advice on starting a storefront or small operation, see this guide to starting a car modification business. That resource outlines steps for legal setup, budgeting, and local compliance.

When these levers work together, the aftermarket becomes more than a hobbyist market. It transforms into a strategic industrial segment. It deepens supply chains, builds regional capabilities, and strengthens global trade links. The modification industry thus acts as a flexible engine for economic resilience. It supports job creation and raises export potential. It also accelerates the adoption of advanced materials and electronics across the entire automotive sector.

For a deeper look at market sizing and long-term growth projections, refer to the industry report linked below.

Source: Car Modification Market Size, Share & Growth Report, 2034: https://www.marketsandmarkets.com/Market-Reports/car-modification-market-3688.html

Final thoughts

The car modification industry stands as a testament to the economy’s adaptability, showcasing its potential to fuse passion and enterprise. Drive forward by nurturing the creativity and innovation spawned within this vibrant sector, we see new economic pathways emerge, aligned with consumer desires for personalization and performance. This industry has evolved beyond mere hobbyist activities into a formidable economic force, touching on aspects of job creation, technological advancement, and ever-evolving supply chains. Embrace the drive; the road ahead is paved with opportunities, pushing economies toward modernization and prosperity.