Car modification laws have emerged as critical players in shaping not just the automotive landscape but also the broader economic environment. As these laws evolve, they significantly influence how enthusiasts and professionals engage with the market, affecting everything from spending patterns to industry structures. In this exploration, we’ll uncover the far-reaching economic implications of car modification laws, beginning with their role in market growth. Next, we’ll examine how these regulations modify consumer behaviors and spending patterns. We’ll then delve into the workforce impact, assessing how compliance affects job creation and industry structure. Finally, we’ll provide a geopolitical perspective, illustrating how car modification laws can tune national economies across the globe.

How Regulation Shapes Aftermarkets: Economic Pathways from Rules to Growth

Car modification laws act as a lever that pulls market forces in predictable and surprising directions. When rules are clear, consistent, and enforced thoughtfully, they convert a fragmented hobbyist scene into an organized industry. When rules are uncertain or punitive, they push activity underground, raise compliance costs, and limit investment. This chapter traces the economic mechanisms by which modification laws translate into market growth, examines regional contrasts, and explains why smart regulation can multiply jobs, innovation, and trade while heavy-handed approaches can compress opportunity.

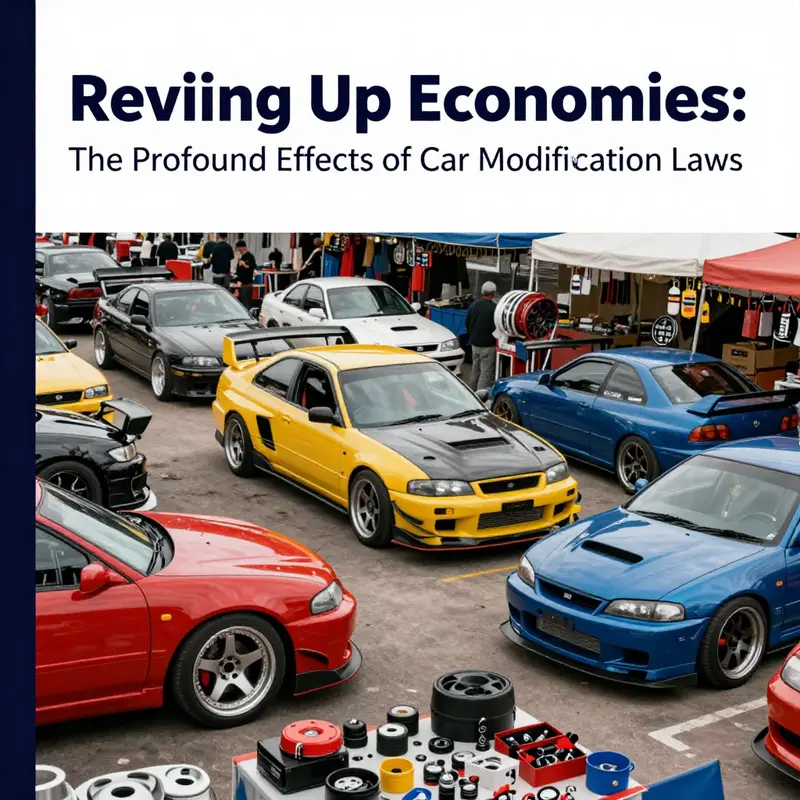

Legal clarity changes incentives at the consumer level first. Clear boundaries around what is allowed reduce the perceived risk of investing in upgrades. Buyers who once feared voiding warranties or facing fines begin to spend more on personalization and safety improvements. That shift increases demand for certified parts and professional installation. On the supply side, firms respond by scaling production, investing in design, and training technicians. The market therefore moves from informal, small-scale transactions toward standardization and higher-value services. This professionalization underpins durable demand that attracts outside capital and fosters sustainable business models.

Regulatory frameworks also shape the product mix. Rules that permit cosmetic changes, interior upgrades, and certain lighting or accessory modifications create immediate markets for compliant components. At the same time, restrictions on high-risk performance alterations push the industry toward safer innovation. When governments require certifications or homologation for specific components, they raise technical standards. That may increase unit costs for parts but improves product reliability. Over time, higher reliability lowers total ownership costs for consumers. It also creates export opportunities for manufacturers that can demonstrate compliance with established safety and emissions regimes.

A second economic channel is the reduction of transaction costs. Simplified registration and transparent approval processes reduce administrative friction for consumers and businesses alike. When registration can be completed through streamlined online platforms, the time and effort required to legalize a modification drops sharply. Lower friction raises the effective demand curve. More transactions happen legally, which expands taxable economic activity. That creates direct fiscal benefits and supports formal employment in workshops, supply chains, and certification bodies.

However, regulation is not cost-free. Certification requirements and testing procedures impose compliance expenses. Small, independent garages may struggle to meet documentation, equipment, and training demands. As a result, the industry can trend toward consolidation, with larger certified workshops gaining market share. Consolidation has mixed effects. It can drive efficiency gains and quality improvements. But it can also reduce competition, leading to higher prices and less local entrepreneurship. Policymakers must weigh these trade-offs when designing compliance thresholds and fee structures.

Enforcement costs form a separate, but related, economic burden. Some measures, such as bans on excessive noise or illegal exhaust systems, demand sophisticated monitoring equipment and sustained law enforcement efforts. Public agencies must invest in detection technologies and allocate personnel for roadside inspections. Those costs are borne by taxpayers and, indirectly, by consumers through taxes and fees. Yet strategic enforcement reduces negative externalities—noise, pollution, and road safety risks—that impose social costs. Effective rules thus shift expenditure from reactive enforcement of illegal behavior to proactive support of the legal market.

The interplay between original manufacturers and the aftermarket is central. When vehicle makers provide factory-approved modification packages, they extend the legal and commercial ecosystem for upgrades. These channels lower legal ambiguity for consumers and create a standardized supply of compatible, certified components. The commercialization of approved packages draws mainstream buyers into the customization market and broadens its demographic reach. For aftermarket firms, this trend creates opportunities to collaborate with OEMs, supply certified parts, and co-develop service networks. It also raises the bar for independent vendors, who must match quality and certification standards to remain competitive.

Regional policy differences shape comparative advantage. In some markets, regulators are tightening mandates on new vehicle emissions and encouraging rapid electrification. That creates demand for aftermarket solutions tailored to electric vehicles and new powertrains. In other jurisdictions, policymakers have slowed the pace of mandatory electrification to preserve jobs and plant viability in traditional manufacturing regions. Those choices keep the installed base of internal combustion vehicles economically relevant for longer, maintaining larger markets for traditional modification services. Thus, regulation influences not only the size but also the composition of aftermarket demand.

China illustrates how targeted regulatory modernization can unlock latent demand. Clarified technical inspection rules, coupled with simplified online registration, have converted gray-area activity into a regulated market. This legal recognition encourages reputable firms to enter the space and enables suppliers to scale. As consumers gain confidence that their investments will be recognized and remain legal, purchases of certified accessories and professional services rise. The result is growth in formal employment, increased tax revenues, and more robust supply chains for locally produced parts.

Global market indicators reflect these dynamics. Measured across regions, the aftermarket shows steady expansion driven by consumer appetite for personalization and performance. Projections from recent analysis indicate rising global market values over the next decade. These forecasts assume continued regulatory attention to safety and emissions, along with increased collaboration between regulators and industry. Harmonization of rules across borders would further amplify growth by lowering trade costs and enabling cross-border supply chains to function more efficiently.

Yet the promise of growth depends on policy nuance. Rules that encourage incremental, certifiable changes stimulate innovation in materials, lighting, and interior systems. Conversely, blanket prohibitions on broad classes of modifications can push activity into unregulated spaces. That underground activity undermines safety goals and compresses tax bases. A balanced approach favors permissions for low-risk modifications, rigorous standards for high-impact changes, and accessible compliance pathways for small businesses.

Investment flows respond predictably to regulatory clarity. Venture and private capital prefer sectors where regulatory risk is manageable. When compliance pathways are explicit, capital allocation shifts toward product development, manufacturing scale-up, and training programs. That investment accelerates productivity gains and enables firms to compete internationally. In addition, a visible, legal market for certified parts supports vocational training programs and creates stable career paths for technicians, welders, and engineers.

Employment effects extend beyond service bays. Growth in certified aftermarket industries creates demand for design professionals, materials scientists, logistics workers, and certification specialists. These roles often pay higher wages than the informal customization jobs they replace. Furthermore, firms that scale can export certified components, adding trade surpluses and supporting manufacturing clusters. Clusters, in turn, reinforce innovation through knowledge spillovers and supplier networks.

Consumers gain predictable benefits from a regulated market. Improved safety, standardized quality, and clearer resale implications reduce financial risk. Well-functioning regulation can also protect insurance markets by clarifying what modifications are disclosed and covered. When insurers can price risk accurately, they avoid broad surcharges that penalize all owners. This precision keeps modification affordable for mainstream buyers and sustains demand.

Policymakers have practical levers to maximize upside and limit downside. They can set graduated certification requirements scaled to market size. They can subsidize training for small workshops to meet compliance standards. They can create fast, low-cost registration channels. They can also foster pilot programs that test monitoring technologies and permit controlled innovation in safety-critical areas. These interventions spread compliance costs more equitably and maintain competition.

In sum, car modification laws are not peripheral to the economy. They actively reshape consumer choices, industrial structures, and investment flows. Where regulations provide clarity and accessible compliance, aftermarkets professionalize and grow. Where rules are opaque or excessively punitive, innovation is stifled and activity slips beyond oversight. Smart regulation therefore acts as policy with double benefits: it safeguards public goods while unlocking substantial market potential. For nations navigating energy transitions and industrial change, these laws are a practical tool for steering employment, trade, and technological progress.

For further market data and projections on the car modification sector, see the market analysis report from MarketsandMarkets: https://www.marketsandmarkets.com/Market-Reports/car-modification-market-47189117.html

For specifics on how Chinese regulations define permissible changes and how that shapes industry behavior, consult this resource on legal car modifications in China: Legal car modifications in China.

Shaped by Statutes: How Car Modification Laws Rewire Consumer Behavior and Spending in the Aftermarket Economy

When legal rules define what a vehicle may carry, they do more than protect safety; they organize the economy that grows around modification. Laws set the boundaries within which households decide how to spend, how to value a car, and how a community signals taste and status through its streets. The presence of a clear regulatory framework does more than prevent chaos; it shapes expectations, risk calculations, and the velocity of investment in the aftermarket. In this sense, consumer behavior follows the contours drawn by statutes as surely as it follows the engineering limits of a chassis. The story of modification spending is therefore a story of incentives, penalties, and the social meanings attached to what is allowed.

Regulatory clarity, exemplified by China’s GA801-2025 update, turns ambiguity into a reliable map. Before such rules, many buyers faced a gray zone where a popular wheel swap or a small rear spoiler could swing in or out of legality depending on the official who happened to review the vehicle. With the new standard, the once-uncertain market becomes a recognized sector, and that recognition changes consumer psychology. People perceive a safer path to customization, one that reduces the risk of fines, warranty disputes, or impounded vehicles. For households, that translates into more confident budgeting for improvements, more deliberate decision-making about what to modify, and a longer horizon for planned upgrades. The regulatory clarity also lowers the information barriers that often prevent first-time buyers from entering the market, widening the set of potential customers beyond enthusiasts who already know the ropes.

Another major shift comes from the simplification of registration and documentation. The Traffic Management 12123 app and its online processes reduce friction barriers that once required in-person visits to municipal offices, multiple stamps, and uncertain processing times. When the steps to register a change in color, or to certify a lighting upgrade, or to document the permissible wheel dimensions are easy, fast, and trackable, more people feel comfortable making changes that improve comfort, safety, or aesthetics. This friction reduction does not simply speed up transactions; it reshapes the demand structure of the aftermarket. Consumers who might have hesitated because they could not navigate the paperwork now consider the total cost of ownership to include only the parts and labor, not the risk of penalties. The result is a more dynamic flow of money into certified parts, installation services, and inspection fees that power a broader ecosystem of skilled labor.

Legal allowances also redefine what counts as a reasonable upgrade. Allowing wheel changes within original dimensions, modest rear spoilers or roof racks up to a certain height, color changes when properly registered, interior lighting and seating improvements, and certified matrix LED headlights are not trivial permissions. They are categories that identify a predictable business line for compliant suppliers and trained technicians. When a consumer chooses interior lighting or safer headlights, they are often choosing a package that includes not only product quality but also a service chain—consultation, verification, and post-installation testing. This creates lasting relationships between customers and certified workshops, and it progressively normalizes a set of modifications as routine maintenance rather than risky experimentation. The economic ripple is clear: a stable demand curve for compliant components reinforces professional opportunities, from design and engineering to manufacturing and after-sales support.

Yet, the same rules that unlock opportunity also constrain it. The economic cost of enforcement and compliance can be substantial. Police use acoustic sensors to monitor high-decibel exhausts and other prohibited modifications, a technology investment that adds to public safety expenditures and, ultimately, to the price of doing business for workshop operators. Certification requirements for performance changes—such as ECU tuning or brake system upgrades—create entry barriers for small, independent garages. This can lead to market consolidation, with larger, certified centers capturing a disproportionate share of demand. In practical terms, costs rise for consumers seeking non-standard updates. They may pay more for options that are pre-certified or approved, and they confront longer waits at official inspection points. This translates into a reshaped price landscape: some items become more expensive, while others—like basic, compliant modifications—become steadily more accessible as the market scales up and competition among certified providers intensifies.

There is also a macroeconomic dimension to these regulatory dynamics. A regulated, transparent market for modifications invites longer-term investment. Component manufacturers, engineering firms, and service networks can plan with greater confidence because the rules, costs, and certification pathways are clear. This reduces the risk premium associated with innovation in the aftermarket and fosters job creation in specialized fields—industrial design, electronic control expertise, upholstery, lighting engineering, and regulatory compliance. In an economy that is both tech-forward and risk-averse about public safety, such predictable demand signals can attract capital that would otherwise flow into less certain ventures. China’s case, in particular, points to a booming aftermarket potential: if analysts’ forecasts hold, the legal modification ecosystem could reach well into the trillions of yuan, propelled by a 15.8 percent annual growth rate and a widening base of compliant products and services. Those numbers, when translated into local employment and supplier networks, imply a significant reshaping of regional labor markets and value chains.

Across borders, the policy stance in Western economies reinforces a complementary dynamic. While the EU, the United States, and Canada recalibrate their approach to incentives surrounding internal combustion engines and the pace of electrification, they carve out space for the legacy aftermarket to adapt. The EU’s revised 2035 target, for instance, contemplates synthetic fuels and low-carbon materials as a bridge rather than an abrupt cessation of ICE activity. In the United States, policy discussions that seek to balance affordability with auto manufacturing employment reflect a sensitivity to the cost of rapid technological transitions. These regional contrasts do not diminish the central point: regulation shapes consumer expectations. When laws make the consequences of modifications legible and the pathways to compliance clear, households are more willing to reallocate spending toward certain upgrades and away from others. The psychology of risk, the framing of rules, and the reality of costs converge to guide decisions about how to spend, save, and insure a modified vehicle.

From a consumer perspective, modification laws function as behavioral levers. They influence not only what people buy, but when and how they plan purchases. Stricter rules restrict or penalize engine tuning, aggressive exhausts, or radical chassis work; that discourages or postpones high-cost performance upgrades. People may substitute with more affordable, non-regulated interior accessories or cosmetic changes that are easier to approve and less likely to trigger regulatory scrutiny. In areas with clearer, supportive rules, customers may be more inclined to pursue elaborate performance packages, provided the path to compliance is straightforward and the cost is justifiable in their budgets. The presence of pre-certified components becomes more valuable because they reduce the perceived risk of warranty disputes or post-sale liability. And because the fear of penalties, vehicle impoundment, or warranty voiding remains an ever-present counterweight, many buyers gravitate toward options that harmonize personal expression with safety and legality.

Framing matters. The same laws can be interpreted as constraints or as opportunities, depending on how they are communicated and enacted. When attitudes toward modification are shaped by incentives that reward compliance, buyers may view legal upgrades as a kind of social norm rather than a risky deviation from the mainstream. This has measurable effects on spending behavior. For example, a consumer more exposed to normative messages about safety, eco-friendliness, or community pride may be more willing to finance an approved customization. In contrast, a punitive tone warnings about fines and penalties usually suppresses experimentation and pushes spending toward safer, cheaper options. The research on incentive framing and social norms explains this dynamic in broader terms and helps illuminate its relevance for car modifications.

In practice, all these forces converge to shape a single question for policymakers, manufacturers, and consumers alike: what is the right balance between safety and creativity, cost and value, restriction and opportunity? The numbers tell part of the story, but the lived experiences of households reveal the rest. Consumers who navigate a well-defined path to compliance are more likely to view modifications as a routine improvement rather than a gamble with legality. They may be more willing to invest in higher-quality parts, professional installation, and ongoing maintenance, which in turn sustains a more resilient, skilled labor market. The consequence is a more stable aftermarket economy where spending is concentrated on certified, traceable components and services that support safer roads and more robust resale markets. And that, in turn, feeds into broader economic indicators such as consumer confidence and discretionary spending, both of which contribute to GDP growth in sectors tied to mobility and personal expression.

The practical implication is clear for households and for the communities that supply the aftermarket. A regulatory regime that reduces uncertainty around what can be changed and how it must be changed turns modifications from a high-risk hobby into a structured, growth-oriented activity. At scale, it reallocates consumer budgets from uncertain, DIY experimentation toward professional, compliant upgrades that are visible in the streets and in the showroom. It also stimulates the value chain of the aftermarket—design firms that tailor components to strictly defined categories, training programs for technicians, certification bodies that maintain high standards, and service networks that ensure quality across locales. These shifts matter not only for consumer satisfaction but for regional economic vitality. As the market clarifies, more households participate, more businesses invest, and more jobs emerge in design, engineering, and field service. The chain reaction moves beyond personal choice to the health of the broader economy.

For readers seeking a quick touchstone, consider the practical question of cost: How much are car modifications? How much are car modifications?. The answer varies widely, depending on the modification, the certification route chosen, and the labor market conditions. Prospective buyers can consult the prices of compliant components, compare quotes from certified installers, and weigh the long-run costs of maintenance against the upfront price. The point is not to promise cheap thrills but to highlight that clear rules, accessible pathways, and trusted services align consumer budgets with legitimate opportunities. This dynamic, in turn, sustains employment and supports a more robust, formalized marketplace for modifications, even as it raises the floor for what people must spend to stay compliant.

The chain of consequences does not end here. Insurance considerations, resale value, and the reliability of repairs grow more predictable when the aftermarket operates within a regulated framework. People who modify their cars within the law tend to face fewer disputes with insurers and more straightforward depreciation trajectories because the enhancements are documented and traceable. Those effects reinforce the consumer decision to invest in compliant upgrades, generating a positive feedback loop that supports continued spending on quality parts and professional services. In this way, modification laws contribute to a safer, more transparent, and economically meaningful culture of customization that aligns personal aspirations with public interests.

In closing, or rather in movement toward the next chapter, it becomes evident that modification laws are less a constraint on individuality than an architecture for sustainable growth. They set expectations, nurture skilled labor, and channel discretionary spending into a measured, productive direction. The economy benefits when people are confident that upgrades are safe, legal, and well-supported by a mature supply chain. The same forces that elevate consumer trust also attract producers to invest, research, and develop in ways that improve products, reduce waste, and advance standards across the industry. As the market matures, the aftermarket becomes a more coherent, resilient sector that contributes to employment, productivity, and regional competitiveness. The conversation extends beyond the driveway; it touches finance, insurance, education, and public policy—areas where the measurable impact of lawful modification resonates with sound economic logic. For those who write, assemble, and revise the rules, the challenge is to maintain clarity without stifling curiosity, to balance safety and aspiration, and to preserve both the vitality of the aftermarket and the integrity of the roads.

External resource: How incentive framing can harness the power of social norms.

From Wrenches to Workforces: How Modification Laws Reshape Jobs and Industry Structure

Regulation recasts the aftermarket. When governments rewrite the rules for vehicle modifications, they do more than adjust technical standards. They reconfigure markets, retrain workers, and redraw the map of where value is created. Clearer rules reduce legal ambiguity. They also raise the bar for who can compete. This chapter follows how compliance demands, certification rules, and enforcement technologies shift employment patterns and industry structure across the automotive modification economy.

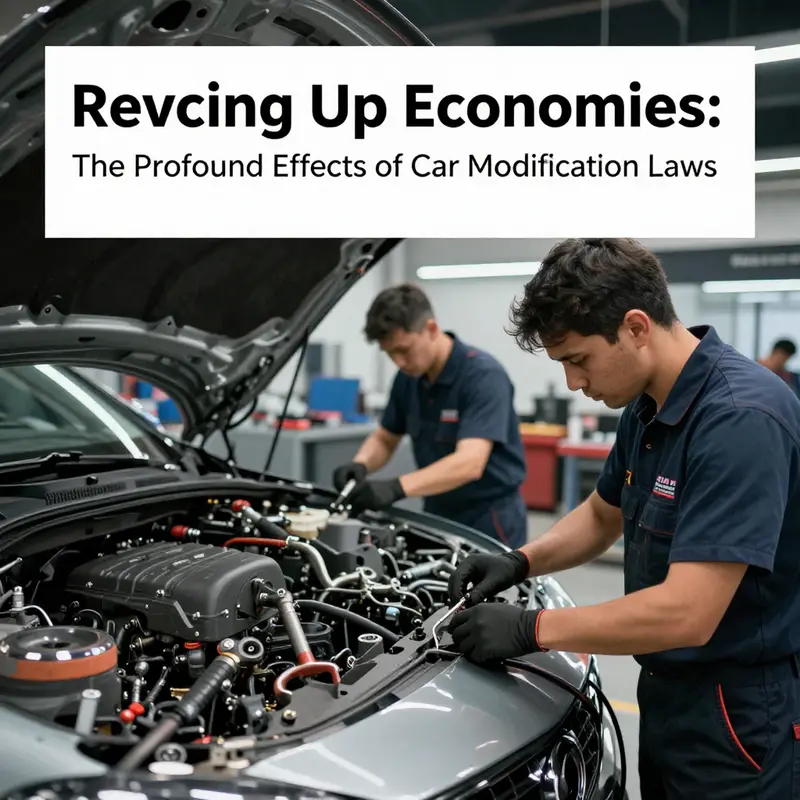

Regulatory compliance is the first pivot point. Technical and environmental standards require parts and installations to meet measurable criteria. Shops must test, document, and sometimes certify work. Those tasks add labor hours and require specialized equipment. Small independent garages often lack these resources. Their margins shrink when they must buy emission testing kits, acoustic meters, or diagnostic software. Over time, many face a stark choice: invest in compliance or exit the market. That dynamic accelerates consolidation.

Consolidation reshapes the industry. Larger enterprises can amortize the cost of testing equipment across many jobs. They can hire compliance specialists, register as certified installers, and negotiate supply contracts with approved parts makers. These firms expand their market share, while smaller shops either specialize in permitted low-risk services or close. The result is fewer, but larger, service centers in many regions. Centralized operations favor scale and traceability. They also make it easier for regulators to monitor compliance. Yet, they reduce geographic diversity of services, affecting rural and low-income urban areas where small shops once prevailed.

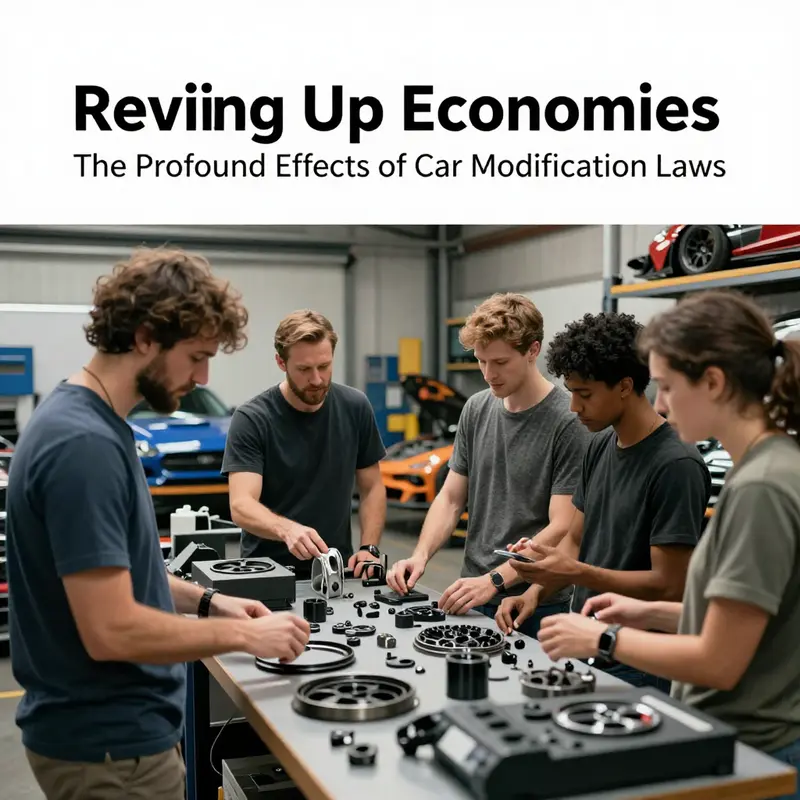

Employment patterns change alongside firm structure. Jobs in small, generalist workshops decline. Roles that once required hands-on mechanical intuition shift toward compliance-focused tasks. Routine labor—bolt-on upgrades or cosmetic work—moves to larger chains with standardized processes. Conversely, demand rises for technicians trained in advanced diagnostics, emission control systems, and regulatory documentation. New roles emerge for compliance managers, test technicians, and certification liaisons. These positions often require formal training and certification, which creates a distinct skills premium.

There is a short-term contraction risk. When regulations take effect, many small operators cannot meet immediate requirements. They lay off workers or reduce hours. Local economies that relied on independent garages feel the shock. Over time, however, the demand for certified services can generate net job creation. Certified facilities expand, and suppliers of compliant parts grow. Component designers, test equipment manufacturers, and logistics providers add staff. The net effect depends on regulatory design and supporting policies for workforce transition.

Policy details matter for labor outcomes. Requirements that are prescriptive—mandating expensive certification for a wide range of modifications—heighten barriers to entry. They accelerate consolidation and may concentrate employment in urban centers. Conversely, regulations that allow tiered compliance, or subsidize training and equipment for small shops, can smooth the transition. Where governments combine standards with accessible certification pathways, the market retains more small players. That preserves local employment and consumer choice.

Certifications change the nature of expertise. Technical competence alone no longer suffices. Workers must combine mechanical skill with proficiency in digital diagnostics, legal compliance, and quality assurance. Training programs therefore adapt. Vocational schools add modules on emissions systems, sensor calibration, and digital record-keeping. Apprenticeships evolve to include formal certification milestones. Employers increasingly value documented credentials as evidence of competence. For workers, this shift offers both risk and opportunity: those who retrain can access higher-paying, more stable jobs; those who cannot may be left behind.

Supply chains and distribution networks contract around compliance. New product certification requirements encourage suppliers to pursue quality assurance and to scale production. This often centralizes procurement in larger distributors and OEM-certified channels. Independent parts sellers face higher testing costs. As distribution centralizes, local service providers lose access to a diverse parts market. This can raise costs for consumers and reduce the viability of boutique modification services. However, it also encourages manufacturers to invest in compliant, standardized components. That investment can spur innovation in safe, high-performance parts tailored to the legal framework.

Enforcement technologies amplify the structural effects. Acoustic sensors, remote diagnostics, and integrated roadside testing require substantial public investment. When enforcement becomes technologically sophisticated, the margin for non-compliant operation narrows. Firms that already invest in compliance face lower risks, while rogue operators encounter higher penalties. The increased cost of evasion alters market incentives, encouraging firms to legitimize operations or exit. Enforcement thus reinforces consolidation trends and bolsters demand for certified service providers.

Regional implications are uneven. Urban centers with dense vehicle populations support large certified hubs. These hubs attract skilled labor and specialist suppliers, creating localized clusters of expertise. Rural areas, with fewer vehicles per shop, find it harder to support certified centres. Residents in these regions may face higher travel costs and longer wait times for compliant modifications. Policymakers must weigh equity concerns if regulations inadvertently disadvantage remote communities or exacerbate regional unemployment.

There are deeper economic trade-offs. Centralization can raise average productivity and safety. Larger firms can invest in quality control, reducing accidents and pollution. They can also provide stable employment and benefits. But reduced competition can increase consumer prices for modifications. Small entrepreneurs, who once offered low-cost alternatives, find fewer niches. The concentration of market power can stifle creative, low-cost innovation that often originates in grassroots workshops.

Opportunities also arise. Clear legal frameworks attract investment. Component makers and service chains see predictable demand and regulatory clarity. They invest in R&D for compliant products. That investment spawns new jobs in design, engineering, and supply logistics. Additionally, digital platforms that streamline registration and compliance lower administrative friction. Where governments integrate simplified online registries, more operators choose to legitimize services rather than remain underground. Such platforms can expand the formal labor market and broaden tax bases.

Transition policies can influence outcomes profoundly. Subsidized training, equipment grants, and tax incentives for small shops reduce the risk of job loss. Governments that fund mobile compliance units help rural operators meet standards without massive capital expenditure. Public-private partnerships can develop certification curricula tailored to the aftermarket. These measures preserve employment diversity while achieving safety and environmental goals.

The Chinese example illustrates these dynamics. When regulations clarified legal modifications and simplified online registration, demand for compliant parts surged. Analysts forecast large market growth. That growth translated into hiring for certified workshops and suppliers. Yet, the same rules required certification for key performance upgrades. Smaller garages faced higher barriers. The net effect depended on whether training and registration tools lowered friction for small operators.

Globally, different policy choices produce different labor paths. Western adjustments to vehicle mandates aim to preserve traditional industry jobs in some regions. Where policymakers slow the pace of technological transition, they maintain demand for legacy skills and production. That can protect existing employment but can also delay modernization of the workforce. The balance between protecting jobs and encouraging new skill formation is delicate.

Ultimately, modification laws are a lever of industrial policy. They shape where work is done, who does it, and what skills matter. Carefully designed regulations can steer markets toward safer and cleaner outcomes, while preserving pluralistic employment patterns. Poorly calibrated rules risk concentrating market power, displacing workers, and reducing consumer choice. The policy challenge is to align safety and environmental goals with measures that support small businesses, expand training, and ensure regional equity.

For a detailed analysis of how institutional regulations shape industry structure and labor dynamics in the auto sector, see the research on block exemption regulation: https://www.researchgate.net/publication/307214568InstitutionalimpactsonindustrystructureTheblockexemption_regulation

For guidance on starting a compliant workshop, see this practical resource on how to open a car modification shop: how to open a car modification shop.

null

null

Final thoughts

Understanding the intricate relationship between car modification laws and economic outcomes reveals how regulations can catalyze market growth while also shaping consumer behavior and employment structures. This duality illustrates the importance of a balanced regulatory approach, one that encourages innovation while ensuring safety and sustainability. As countries navigate the complexities of the automotive landscape, the learning from diverse regulatory environments will be invaluable for enthusiasts, businesses, and policymakers alike. Moving forward, the automotive aftermarket collective must continue to advocate for laws that benefit both the industry and the passionate individuals who fuel its progress.